The International Imperative

French authorities have jumped into action to tackle waste head-on with their impressive anti-waste law (Law No. 2020-105). Say au revoir to the old “produce, consume, throw away” mentality as France paves the way towards a circular economy. This law aims to slash waste and educate consumers, bringing a much-needed wave of change.

This legislation takes a significant step-change by banning the systematic printing and distribution of post-purchase receipts in bricks and mortar stores, including credit card receipts and those from ATMs, to offer customers a new approach. Once it takes effect, it will bid adieu to the days of endless paper receipts cluttering up our lives. The reign of paper receipts is on a swift decline, making way for a more eco-friendly and streamlined approach.

Why this, why now?

“I don’t need a Re—…” You trail off as you realise the receipt has already printed halfway; you scrunch it up and dump it in a bin by the till. In many cases, customers don’t even receive the receipt before discarding or forgetting it in a bag. It’s about time the industry takes a stand on tackling such unnecessary waste.

In France, it’s estimated that an average hypermarket uses over 10,000 rolls of thermal paper a year. There’s no shortage of statistics that point out the negative environmental impact paper receipts generate each year.

“The anti-waste law for a circular economy that we present is an ambitious piece of legislation to come out of the throw-away society. It proposes a more sober daily life in which manufacturers are more accountable, local authorities are relieved, and consumers are better informed to become more involved in the transition during their purchases. A time when producing to destroy is no longer acceptable.” Brune Poirson, Secretary of State attached to the Minister of Ecological and Inclusive Transition

As of summer 2023, while consumers have the right to request a paper receipt,, we expect to see many retailers utilise this opportunity to capture customers’ details with digital receipts.

Are other countries following suit?

Germany

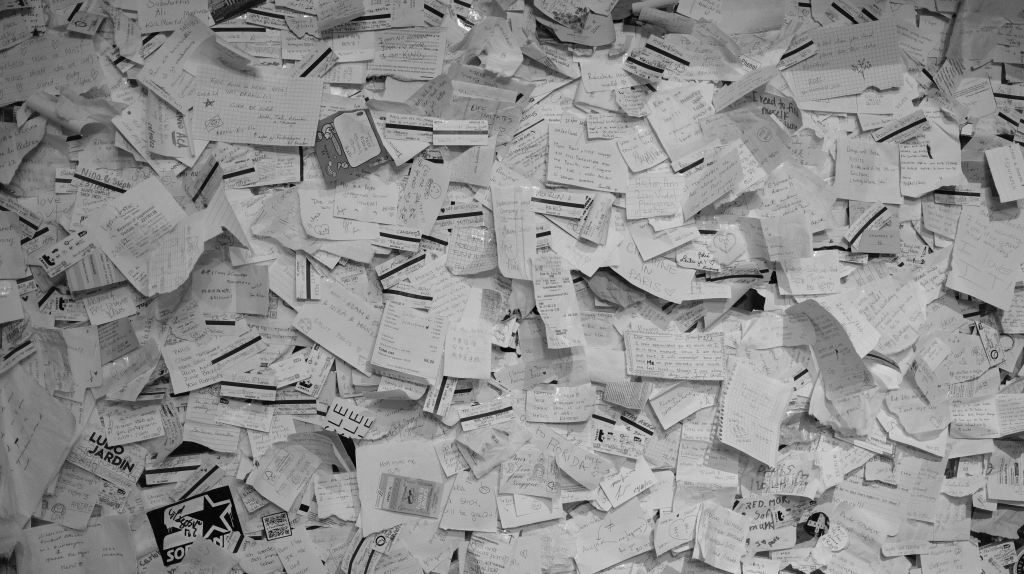

Let’s look at one of France’s neighbours. Germany has mandated that all retail businesses must offer a receipt, a decision that has garnered strong opinions on both sides of the fence. The law aims to combat tax evasion, estimated at around 10 billion euros by tax officials. But the decision has not proved popular with many who lament the significant waste, posting photos of overflowing bins and receipts taped to windows in protest. Take a look at pictures from the Jahn bakery in Ansbach, Bavaria, who collected customer receipts in their window to demonstrate the waste.

With so many consumers unhappy with the requirements of this law, we forecast to see a rise in the adoption of digital receipts as consumers adopt responsibility for reducing their carbon footprint.

Sweden

Consumers in Sweden are increasingly opting for digital receipts. “Paper receipts are limited in their design. We want the receipt to be more interactive, something the customer wants to keep or share, which creates added value. By focusing on what each customer wants, our digital receipt service can enhance the shopping experience”, says Carita Weiss, Head of Payments at Coop Sweden.

Finland

A study in Finland calculated that by digitising paper receipts, many retailers were experiencing significant economic benefits, around 5-7 Euros per transaction. The saving was made up of automation in decision-making, forecasting and administrative reports due to the digitisation. As well as saving paper and printing costs.

Italy

In Italy, we’ve witnessed a novel approach to tackling receipts in the form of the “Lottery of Receipts.” Any transaction includes an invitation to participate in a state lottery, with each electronic receipt representing an entry. Retailers not offering this are liable to pay a fine! Digital receipts are a must-have if you want to operate in Italy.

The Role of Fiscalisation

Depending on your role, you may not be familiar with this term, but it’s an important one. In a nutshell, Fiscalisation exists to streamline tax calculation and collection and to prevent VAT fraud.

As you may know, if you sell in some countries*, you must ensure that you report your VAT transactions to authorities, which means your retail systems must meet requirements for these fiscal laws.

*such as Austria, Bosnia & Herzegovina, Bulgaria, Croatia, Czech Republic, France, Germany, Greece, Hungary, Italy, Norway, Poland, Romania, Serbia, Slovak Republic, Slovenia, Sweden, or Ukraine

Unfortunately, each country is has different fiscal requirements. Traditionally each transaction generates multiple receipts: one for the authorities and often both a fiscal and transaction receipt one for the customer. It’s no surprise that more and more retailers are seeing the value in using a solution such as Yocuda’s to automate and digitise the receipts for the customer, reducing paper waste and improving the customer experience,

Yet another reason why digital receipts are taking off.

The tide is turning across Europe, with more and more countries examining their laws on paper vs digital receipts. Many countries are taking significant steps to encourage digital receipt adoption both for ethical and sustainable reasons and to provide greater clarity on potential tax evasion and retail fraud.

Rather than waiting for the government to take action, we recommend all retailers explore how they can adopt digital receipts across all of their domestic and international stores.

Get in touch with our skilled team who can help you on your digital receipt journey.